You should pay off your student loan, and here’s why.

2 Jun, 2024

I want to explain why you will often hear me encouraging people to avoid taking out student loans or pay them off as fast as possible if they have them.

My suggestion is more controversial than I realised, and I’m often taken to task for my view, particularly by more mathematically minded people. Over almost eight years of talking with people from all walks of life about money, I have found that student loans keep coming up in conversations with former students.

The simple reason is that what is considered a relatively innocuous decision to take on interest-free student debt has far wider-ranging implications than those borrowers ever realised at the outset. The lure of interest-free and the thought that students are getting a great deal lull people into a false sense of security. I kōrero with many people, and the word that keeps coming up regarding student loans is simple: REGRET. In hindsight, most people I speak with realised that they could have avoided some or all student debt in the first place. The reason they now have regret is that the debt had impacts on their life that they never foresaw. The phrase “If only I knew then what I know now” is unbelievably common.

People are typically young when they take out student loans and have zero concept of the pitfalls of doing it—myself included. Coupled with educators, whānau, and well-meaning adults telling people that interest-free debt is a blessing (“good debt”), not a curse, it’s no wonder that people take it on. Then, as adults, it's rare for people to talk openly about money, so the implications of student debt don’t get discussed. Most assume that others are doing OK.

A search of my blog revealed that my opinions on student debt have always been a hot topic for me. I’ve never liked it, and if you think I’ve changed my mind, I have not:

You Can Avoid Student Debt. Nov 2016

Progress Report on You Can Avoid Student Debt Oct 2017

Investing A Student Loan. Yes or No? May 2019

A Cunning Plan To Help Pay For A Child’s Education. Sept 2019

How To Avoid A Student Loan. Start Saving Today! Dec 2019

How to Pay Cash for Tertiary Education Nov 2021

While I appreciate and am grateful that student loans remove the financial barrier to entry for all students wanting to study, I don’t see getting a student loan as a foregone conclusion. For those heading into some kind of tertiary study, it should be a last resort, not the first. I want to help future students and their whānau consider the long-term financial implications of borrowing money.

I received an email from a tertiary student that prompted this blog post.

Hi Ruth!

I’m currently an 18-year-old university student, and I really enjoy listening to your podcasts while I work my shifts. I find your insights really helpful, but I did have one question. I currently have a decent chunk of money sitting in an investment account, but I am also taking out a student loan to be able to live in the halls of residence. I understand how vehemently you caution against debt, but I am curious what your opinion on my situation would be considering that unlike my student loan, my investments accrue interest. As I have no plans to travel anytime soon, and my student loan will remain interest-free, does it not make more sense to have my money appreciating? Wouldn’t paying off my student loan cause me the opportunity cost of all that interest? Thanks. Nic

Now, there are questions I have for Nic, such as:

Q: How much is a ‘decent chunk of money’?

Q: Where have you invested it, and what is the anticipated return?

Q: What are your ongoing course and living costs in the coming years?

Q: What is the length of your course?

Q: What is your anticipated income once you graduate?

I may never know the answers to those questions, but without knowing any more details, this is still an excellent and valid question that they are asking, and I wanted to take a bit of time to dig into it.

Their argument is a strong one. But only for a short time.

Currently, just four months into their first year of study, their argument stacks up. If you borrow at 0% and invest at 5%, your investment will make you money. It is simple math.

But let me take some time to move beyond four months…

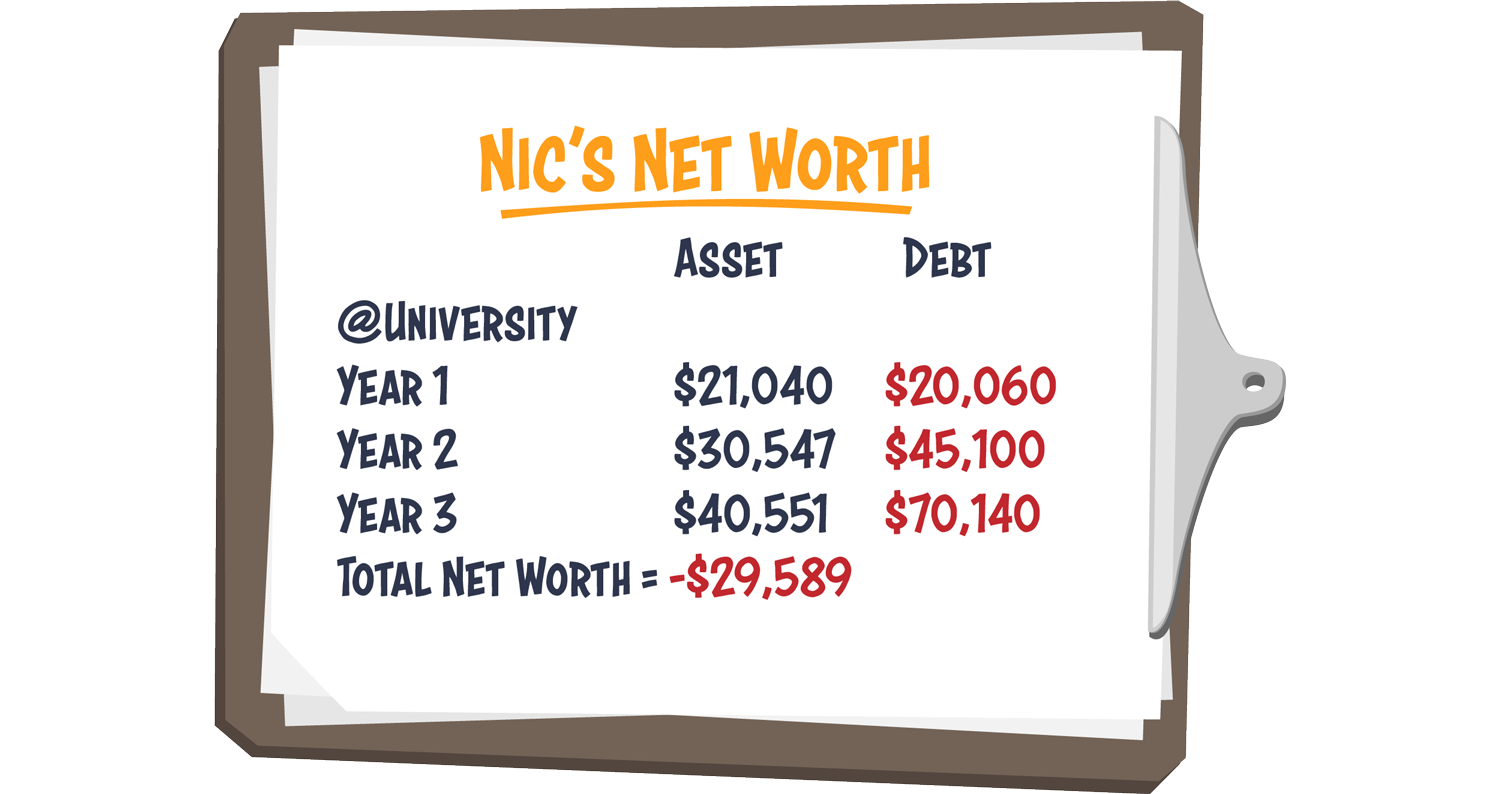

2024 - Year 1 at University

Let’s suppose that Nic’s ‘decent chunk of money’ that they have saved up is $20,000 (a complete guess on my part). As luck would have it, I know from having my daughter attend a Hall of Residence open day this month that the yearly cost is about $20,000.

Let’s assume that Nic takes out student loans to cover the total $20,000 cost* leaving their $20,000 savings intact.

* When you borrow money, strings are almost instantly attached to the lending. I know there are rules around how much money you can borrow to pay for a Hall of Residence or accommodation costs, and my guess at Nic borrowing $20,000 is a guess. They may also borrow money to cover course-related expenses, fees, etc. Also, the first year fee-free is about to end, putting more costs on first-year students. Lending rules can change on a whim. Never forget that.

Let’s assume that Nic invests $20,000 in a one-year term deposit* (calculator) at a rate of 6.30%, that the interest is paid at maturity, and that their tax rate is 17.5%. After one full year, which may or may not coincide with the academic year, their investment would be valued at $21,040. They have made $1,040 after tax.

* Of course, I’ve assumed that Nic is thinking of using a term deposit, one of the safer investment choices. But I’ve met plenty of well-meaning teenagers who plan to invest in far riskier investments, particularly crypto or taking a punt on what they think is a hot stock.

On the other side of the ledger is their new student debt. In the first year, the cost of setting up their student loan is $60, and the loan incurs no interest. At the end of 2024, their student loan balance is $20,060.

So far, Nic’s investment plan has made them a profit of $980.

Winning!

But what if?

A few assumptions have been made throughout the year, and I’ve assumed that Nic kept their sticky mitts off the money and didn’t break their term deposit. I’ve also thought that they didn’t get their first credit card, as they can legally do at 18, and that they didn’t take out credit card debt. Or BNPL, whose use is rife among teens and 20-somethings. My fingers are crossed that Nic kept diligently working those shifts they mentioned and had a little income throughout the year. Maybe they had some financial support from whānau, too?

However, what if Nic hated the course midway through the academic year, changed direction, and loaned the associated costs of doing so? Heck, what if they hated university full stop and left? What if their laptop blew up, and they had to replace their stolen bike? What if the ski season was perfect this year, and their newfound friends pulled them along for a few fun weekends?

Where does the money come from for these expenses? Suddenly, their income and expense calculations are up for debate. The last factual thing Nic did was take out a zero-interest student loan and lock in a one-year 6.30% interest rate. The rest is still being determined, and from then on, Nic will begin to deal less with concrete facts and more with what-ifs.

There is too much uncertainty to make firm plans ahead of time.

2025 - Year 2 at University

Given that Nic already had the get-up and went to work a part-time job while they were studying (something I am a huge advocate of), let’s suppose that Nic worked a solid two months over the summer break and earned $8,000. Let’s also assume they lived for free at home and had no other outgoings (highly unlikely).

Let’s also assume that the maturity of their term deposit is convenient and ends right when they finish their summer job. Now, they can take out a new term deposit using $21,040 from Year 1 and add their $8,000 summer savings, meaning a new term deposit of $29,040.

Given that their last term deposit rate was 6.30%, what is their new rate in 2025? I don’t know. Do you know what the interest rate will be in 2025? We kinda need to know for his scenario to work, right? It could go up, or, as we have all discovered over the last five years, it could also go way down. From this point on, you have no guarantee of the return on your investment. Nic is going to have to guess. Let’s stick with 6.30% for another year.

Meanwhile, our student goes back to university for their second year, only this time they will incur course fees, plus they will have to pay their accommodation costs, all expenses associated with their study, and general living expenses. An estimate, given current rates, is $30,000. Given that they are doing part-time mahi let's assume that Nic only borrows $25,040 using their student loan. They will also pay $40 a year as an administration fee, and this annual fee will continue (and probably increase) until their student loan is paid back in full. Who knows when that will happen?

By the end of 2025, Nic will owe the government $45,100 in interest-free student loans, and their term deposit value will have increased to $30,547. They earned $1,507 in interest after tax this year.

Winning!

So far, forgetting other life costs incurred, Nic’s investment plan has made them a total interest amount of $2,547 in two years.

However, the winning ends there because he now has $45,100 in student loan debt.

2026 - Year 3 at University

Another two months of work over the summer means another $8,000 saved to add to the term deposit of $30,547, totalling $38,547. Of course, this assumes that Nic lived rent-free again and had no outgoings (unlikely).

I do not know what type of person Nic is. A sleeping in a tent down by the river for free while working as a fruit picker kind, or the paying for accommodation, attending every summer concert, and enjoying a beverage kind of student. They have vastly different spending habits, and I’ve met both. As adults they all say “I don’t regret a thing!”

But, supposing they are the former, and Nic is a penny pincher and has saved up all his income to reinvest in a term deposit. What will the rates be in 2026? I have no idea. They could be 2% or 10%. Who knows? I’m going to have to guess again that they were 6.30%.

Nic returns to university for the third and final year of their degree. Again, let’s assume they borrow another $25,040 (including a $40 admin fee) to cover course costs, living expenses, etc. Let’s assume the workload is not too significant in their final year, and they still have that part-time job. Hopefully, they’ve even received a pay rise in line with inflation. Maybe they have qualified for a student allowance? Hopefully, Nic’s landlord will not increase their rent this year. But I’m pretty sure they will have. Perhaps course fees have gone up, too? So many unknowns!

As 2026 and Nic’s tertiary studies draw to a close, let’s look at Nic’s money.

Nic graduates after completing a three-year degree course. Their total student loan debt is $70,140 (a significant amount), which, at this point, is only ‘costing them’ $40 a year. They won’t pay any interest as long as they stay in New Zealand. Nic said they have no plans to travel, but I’m not so sure about that.

Their term deposit, which they have added to and reinvested the dividends for three years, is now worth $40,551. In this third and final year, they made $2,003 in interest.

In summary, Nic now owes the New Zealand government (and the taxpayers) $70,140 (debt) and now has $40,551 (asset) in cash.

Nic is $29,589 in debt.

Hopefully, Nic will have a completed degree with good grades to show for it.

2027 - Welcome to the workforce, Nic!

Since we locked in that first-term deposit rate, everything else has been pure guesswork, and I’ve made a lot of assumptions about our student Nic. Most of those assumptions have been that they are brilliant and have been disciplined enough to study hard, pass their course, work during the academic year, work harder during the holidays and not spend a cent, or have any life or world event impede their progress.

What do you do with your invested money now, Nic?

Given that I commonly hear, “Why wouldn’t you get a student loan, it’s FREE money”, and “You should invest your cash instead”, just how much did Nic make from their hypothetical term deposits:

Year 1 - $1,040

Year 2 - $1,507

Year 3 - $2,003

Total interest earned = $4,550

In theory, Nic has gone into “cheap” debt; it cost them only $140 so far to borrow $70,140.

But, what are their plans for their debt now, given that they have received their taxpayer-funded education because they chose to invest their own cash to earn a profit? What was the plan at the end of study?

They should be able to apply their $40,551 cash to their $70,140 student loan, dropping their loan balance to $29,589. Then, they should get a job and pay that remaining debt back. Once they earn over $24,128 a year, they will forfeit 12% of every paycheque to repay their loan (calculator). An average graduate salary of $60,000 will take Nic seven years to pay off $29,589.

The problem I have found is that it's human nature to baulk at using “your money” to pay off your government-funded student loans (taxpayer money). I see it all the time. What invariably happens is that Nic will keep their student loans just as they are, meaning it will now take them 16.5 years to pay them off via 12% slices taken from every paycheque (assuming their income stays the same). Nic will be 37.5 by the time they pay it off, assuming they were able to continue to make payments.

If they don’t put the money they saved up towards debt, it will be frittered away in life:

An updated vehicle for this new graduate

A well-deserved holiday overseas

An overseas holiday of a lifetime

A wedding

An investment product

A downpayment on a house

$100 here. $1,000 there. It will feel like a lot of cash, but given the growing list of things it could be used for, it will fell like nothing at all.

Life will only get more complicated and more expensive, and Nic will find that the conversation will change from I choose not to use my cash to pay off my student loan, to I can’t use my cash to pay off my student loan, because I have other expenses.

Before you embark on investing your money in the first place Nic, ask yourself what the purpose of taking out a student loan when you could have paid cash is. What is your end goal? And when you get there, will you do what you said you will do?

As it stands today, the effort to earn a little interest has left Nic $70,140 in debt. I don’t call that a success. Math meets life.

Nic has failed at every step of the way to account for RISK

I asked my acquaintances for their opinions on Nic’s question, and the number one response I got was that this 18-year-old is not accounting for the most significant factor that can make or break them: RISK.

Risk is the possibility of something going wrong. These events can destroy the best-laid plans. Instead of inviting risk and uncertainty into your life, you can make choices that remove potential risk and harm.

Put simply, Nic, if you have cash to pay for some or all of your education, pay cash, and you will eliminate all the “what ifs” I’ve already mentioned and am about to say. Don’t do the dance with debt that you are proposing to do because, take it from me, having spoken with so many, so much of your guesswork won’t go to plan.

What could go wrong?

After that first year, when things were quite black and white, we had to make an increasing number of assumptions about how life would pan out for Nic.

Based on the sheer volume of students and former students I have enjoyed speaking with over the years, I have a long list of detours life can take:

They didn’t finish their degree in three years. It took longer.

They didn’t finish their degree at all.

They switched majors or changed course along the way, thus extending their university to four years? Or five? Or more?

They completed one qualification and then stayed to complete another, taking more time and taking on more debt.

They were unable to fit in paid work throughout the year.

They travelled for fun during their holidays instead of working. YOLO.

An illness developed that prevented them from studying or working.

They started a family.

An accident meant their tertiary study abruptly ended partway through.

Their rent increased.

Their cost of living increased.

Suppose they sailed through and came out the other end with a freshly minted degree. In that case, I’ve heard of a fair few mishaps that have hit former students:

They graduated into a dead job market.

They were forced to take a job that was different from what they wanted for their career.

Their income didn’t match expectations.

They struggled to make enough money to service the student loan AND meet other financial obligations (mortgages, daycare costs, child support, credit card debt, etc).

Friends and careers took them overseas, and they failed to make voluntary payments for their student loans. The desire to do a long-term O.E. is genuine. As is the 3.3% interest you will incur once you leave the country for a one-year holiday, which turns into a 10-year career.

Love blossoms, and a long-term relationship forms with a partner who also has student debt.

Household student debt impacts the ability to borrow money to buy a home. That 12% deduction could make all the difference between being accepted for a mortgage or declined.

When children come along and paid work ceases, student debt repayments stop (unless you have the foresight and the money to make voluntary payments) and linger for years longer.

Many couples now have separate finances, so the one who pauses work (often the woman) is at a severe financial disadvantage.

Little by little, a good income gets pulled in too many directions: student debt, housing debt, credit card debt, KiwiSaver, and not to mention the fun parts of life that involve spending money on whānau, travel, or buying items that you want.

Sadly, not all relationships work out and with the parting of ways comes the parting of assets AND debts. Student debt gets factored into that and complicates the situation.

Indebted parents then send their children off to university to do exactly the same.

And there is another unknown too, Nic, your supposition that student loans will always remain interest-free. Do you realise that student loans didn’t use to be interest-free and that there is NO guarantee that they will stay that way? Any government could reintroduce interest on student loans. In fact, the government just announced that the interest charged to those who leave the country with a student loan would increase to 4.9% on April 1st 2025. If you have zero student loans, it won’t even be your concern.

Expectation vs Reality

We go to university expecting to earn a good income with the qualifications we work hard to earn, but that is not always the case. Some people choose courses they are passionate about but pay poorly. Others don’t finish a qualification or get one in an area they will never use, yet they will still have to pay off. You can become stuck in low-wage work, which means smaller payments to your debt and a far longer payoff period. I even read that some people are reaching superannuation age, and their pension gets docked to pay their student loan. And I certainly know of several instances of intergenerational student debts: like father, like son. Like mother, like daughter.

Opportunity cost

Nic wondered about opportunity costs and the loss of alternatives when one option is chosen. I would focus less on what you could do with the cash you have and more on what that cash, directed towards your education right now, could do for you in the long term.

You JUST DON’T KNOW what life has in store for you. You want to believe your strategy is risk-free, but it is not. Luck, chance, and the randomness of life (Covid anyone?) will kick you in the face when you least expect it. Your job as a student should be to manage the randomness of your life as best you can and exclude options that have the potential to cause you harm. Student debt has the potential to cause future financial hardship.

I advise you to approach ex-tertiary students of all ages who have used student loans and ask them about their experience. I’m 50 years old, and I finished my study in my mid 20’s. Yet, to this day, I have classmates who are STILL PAYING off their student loans. Some have disappeared to remote countries where the New Zealand government can’t extract payments from them, and their loans have incurred interest all this time, and they can’t step back in New Zealand without facing a massive bill.

Others just never managed to earn the money they thought they would after taking on several additional years of study, so 12% of their meagre income, even with interest-free debt, has never got them to zero. Many had children and left the workforce; no income meant no loan repayment. Many married people that also had debt. Some actively worked to become debt-free, while their spouse didn’t give a toss and kept it around, which caused friction in their marriages. Most, if not all of them, took on mortgage debt too, spreading their take-home pay even thinner. Throw a redundancy into this mix, and you’ve got yourself in a midlife crisis.

And of my friends who paid off their debts? They moved on with life and never looked back.

What should you do, Nic?

What did I do? For my first two years, I followed the herd and took out student loans, which at that time incurred interest of 7% - 8%. Then, I took two years off, worked full time and saved my socks off to pay off my student loan in full, plus pay cash for my future living and study expenses for the next three years. I worked a part-time job while studying, full time in the holidays, plus I was one of the fortunate few with poor parents, and got a small student allowance.

I kept my math simple: how much money do I need to earn to pay upcoming expenses? I finished with an excellent qualification and no student loans.

And then I got on with life and have never looked back. Future financial decisions didn’t hinge on past financial decisions.

There has never been a moment in my life where I have regretted paying off my student loans and paying cash for my excellent education, and via my blog, I’ve had the absolute privilege to meet people who have shared with me the relief they feel at having the student loan debt monkey off their back once and for all.

Please don’t spend the rest of your life paying for something you committed to at the age of 18. Enjoy your tertiary study and all the experiences that come with it, and then move on, taking only memories with you, not a 12% wage deduction for 16.5 years.

Suppose you have done a fabulous job of saving up money prior to going to university, and have continued to earn money throughout the time that you have studied. In that case, the most risk-free strategy you can take for yourself is to pay cash for as much of your study as you can. Only use debt as backup. If you can complete your university study with no debt, or as little debt as possible, then you enter the workforce and the rest of your life in a far stronger way.

What can whānau do to help the Nic’s of the world?

Start your child saving early and discuss the costs of tertiary education as soon as they are considering it. Another unexpected government change has been to charge fees for first-year students (and remove final-year fees), so this has thrown a spanner in the works with future students, my daughter included, left scrambling to save up an extra $5,000 - $10,000 in their first year.

If you or any family members are in a comfortable financial position, please consider assisting your tamariki with their study costs. If you can’t spare money, give them free board or help in non-financial ways. Help them apply for scholarships or find work.

In my experience, most of these young adults moving into study are awesome people, but they feel great pressure as they head out of school, off into the world, and often away from home. Support them in whatever way you can by pointing out the positives and negatives of decisions they are considering making. And for goodness sake, don’t ever let me hear you say, “Everybody gets a student loan; don’t worry about it.” A student loan is not a foregone conclusion, and there is an abundance of adults worrying about the fact that they still have one well into adulthood.

The overwhelming majority of people I speak to who have suffered from the pressure of debt well into their adult lives is that they wish a caring adult had come alongside them and shown them a different way. So, please go and find your “Nic” and start a conversation today.

I’d love to hear your thoughts on student debt in the comments below. Be thoughtful and be kind and write as if it’s an 18-year-old you know reading it 😊