I wanted to share the exact costs of a holiday we took in January of this year when we went to Australia and took our first-ever cruise. I went in hugely sceptical of cruising, but I absolutely loved it. We holiday differently from some: Our holiday is fully paid for before we leave. Paying in advance is a far more relaxing way to travel, indeed, the ONLY way to travel, in my opinion.

All in Budgeting

The Power of an Emergency Fund in a Crisis

As I became aware of the weather event slowly unfolding in the upper North Island and, over the days that followed, the scale and breadth of the carnage it caused, it took me right back to the Canterbury Earthquakes and our experiences of coping with a natural disaster. Since the beginning of The Happy Saver, I’ve talked about Emergency Funds, and I’m not letting up. Although they are fantastic for solving minor money problems, they are even better for giving you strength when the absolute worst happens. An emergency fund comes into its own in a real crisis.

Budgeting for the first time?

Budgeting for the first time? Then, please let me make it as painless as possible! I regularly speak with people who are, for the first time, looking at their money correctly. Like, I mean, actually looking hard at each transaction, which is what you need to do to understand where your money is coming from and going to. For many, we get by; earning, spending, and not taking too much notice. But this “head in the sand” attitude to money will only get you so far and will keep you living week to week or month to month.

Do you think you should combine your finances?

I’ve been having many conversations with readers about money, which is not unusual, but what is standing out a little more is that I’ve noticed that for those who keep their money apart from their spouse, once you start to pile on all the other stressors of life, cracks begin to appear. I suspect that across Aotearoa, there are relationships being tested at the moment. This blog encourages you to face it head-on; start a conversation.

Debt won’t solve your money problems

Recently the banking/lending industry changed the way they view lending applications in response to new government legislation and changes made to the Credit Contracts and Consumer Finance Act. The government’s changes are to protect borrowers, which sounds fair to me. However, my personal view is that banks also saw this as an opportunity to reset the expectations of some borrowers.

Natural spender or natural saver?

I’ve been thinking about the concept of “natural spender and natural saver” for quite some time. When people email me, they will often reference themselves as being very clearly one or the other. They have popped themselves into a category and then used that to explain their views and actions around how and why they handle their pūtea (money) the way they do. It’s never sat quite right with me, and it feels too restrictive and concrete to categorise yourself that way.

What I’ve learnt in five years of personal finance blogging.

To my surprise, I’ve chalked up five years of writing this blog! And I can’t quite believe it. I thought I’d blog today about what I’ve learnt, observed and what it’s like to write a blog because there is not a single day that has gone by that I’ve not emailed or spoken with someone about what I tend to refer to with my whanau and friends as ‘blog stuff’.

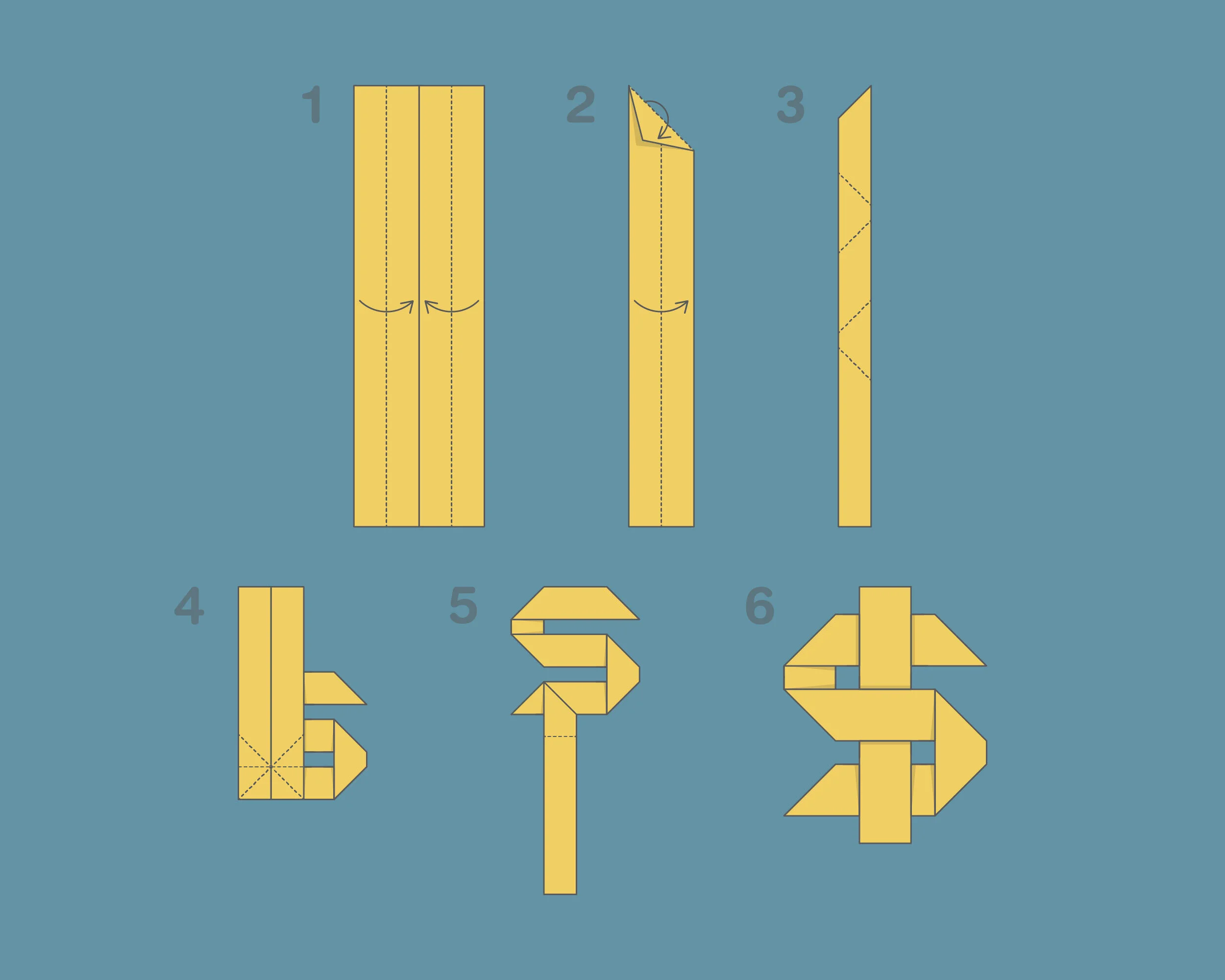

Begin at the Beginning: Step-by-step Path to Financial Independence

Whatever it is that you are embarking on that’s always the best place to start in my opinion. The beginning. Then just follow the path, in my case, the path to financial independence and eventually not being tied to a job to earn my income. It’s a long journey but it’s one worth starting. I’m often writing emails that cover the same points over and over again, so I thought that today I’d put that information into a blog post for all of the people wondering where to start and how to string all the bits of information you have learned about money into a cohesive order.

Reimagining my budgets with PocketSmith

It’s no secret that I’m a fan of budgeting in some way, shape or form and knowing where your money is coming from and going to honestly helps you get ahead faster. There is no doubt in my mind about this. And from time to time I give my budgets an overhaul and this week I made a cup of coffee and took about an hour to look over every corner of my budgets in PocketSmith. The prompt to do this was because PocketSmith have launched a brand spanking new Dashboard with heaps of new customisable features and once I started having a look around, I was like a kid in a candy store.